Investments at a Glance

At Epic Capital Funds, we specialize in recession-resistant real estate investments designed to generate reliable passive income. Investing in real estate offers numerous benefits, including stability, consistent cash flow, and protection against inflation.

Why Real Estate?

Investing in real estate offers a variety of benefits, making it an attractive choice for those seeking recession-resistant passive income. Here are some of the advantages of investing in real estate:

Passive Income

Unlock the potential of real estate to build a robust passive income stream. By strategically leveraging your investment dollars, you can expand your portfolio and enhance your financial stability. Real estate investments offer a pathway to growing your income and achieving financial independence, providing you with the freedom to pursue your long-term financial goals. Discover how real estate can be a cornerstone of your journey to financial success and flexibility.

Ability to Leverage

Transform your investment potential with real estate. Picture leveraging $100 of your own capital to acquire $400 worth of income-generating properties. By securing an additional $300 in funding, you amplify your investment power, enabling significant portfolio growth and enhanced returns. Discover how strategic real estate investments can elevate your financial success.

Increase Value Directly

Directly increase the value of real estate by improving the NOI (Net Operating Income). This can be done strategically through renovations and upgrades, adding amenities, increasing rent, adding additional units, enhancing curb appeal, and zoning changes.

Value = NOI / Cap Rate

Hedge Against Inflation

Real estate historically appreciates over time, leading to increased equity while your fixed-rate mortgage payments remain constant. As market rents rise, rental income also adjusts, reinforcing real estate’s role as a strong hedge against inflation. This combination of appreciating value and growing rental income underscores real estate as a reliable investment for long-term financial stability.

Tax Advantages

Passive real estate investors may be able to take advantage of several tax benefits, including those from accelerated bonus depreciation and tax deferral through a 1031 Exchange. These tax advantages enhance the overall return on investment and make real estate a compelling choice for passive income strategies.

Tangible Asset with Utility

Real estate is a tangible asset that can be seen, touched, and occupied. Real estate has utility because it serves a practical purpose and has a limited supply, making it more valuable as demand for it increases.

Property Types

Epic Capital focuses on three types of properties for investments: Multifamily, Industrial, and Commercial.

Multifamily

Multifamily properties, defined as buildings with five or more units, offer significant investment potential. The key to successful multifamily investing is selecting prime locations, particularly near employment centers where rental demand is higher. Value can be enhanced by targeting distressed or undermarketed properties, though these opportunities can be rare and challenging. While new development projects may require more time, they create valuable, modern assets with reduced risk of economic obsolescence compared to older properties.

Industrial

Industrial properties are a compelling investment choice due to their lower maintenance costs and stable cash flows. They often attract tenants in essential industries like manufacturing, which typically sign longer rental agreements. The location is crucial for industrial properties, as proximity to key transportation networks and logistics hubs can enhance their appeal. These factors contribute to steady and reliable returns, making industrial real estate a robust investment option.

Commercial

At Epic Capital Funds, we also consider investing in other commercial properties, including discount retailers and self-storage facilities, known for their stable cash flows. Essential office spaces remain a viable investment, especially in high-demand areas. As with all investments, location plays a critical role in maximizing returns and ensuring long-term success.

3 Levels of Real Estate Performance

Equity: We invest flexible, high-value resources into projects to ensure they are fully funded and maintain necessary cash reserves throughout their lifecycle.

Debt: Epic Capital Funds builds strategic partnerships with experts across all stages of the project lifecycle to secure long-term financing. This approach ensures a well-structured investment strategy, enhancing success and minimizing risk.

Operations: Our firm assembles a skilled team to enhance Net Operating Income (NOI) through managing asset performance independently of market appreciation. Throughout the project lifecycle, we create value through optimizing operations and value engineering during the design/build process. This strategy can deliver stable and predictable returns through cash flow or equity upside.

If you have any questions about investing in real estate with Epic Capital Funds, please reach out. We believe in creating long-term, successful partnerships with our investors.

Current Opportunities

$1,000,000

Epic Capital Co-GP Fund I

Schedule of Projects:

First Project: Three Thirty Six Apartments (Salt Lake City, UT)Second Project: Peoria Commons Apartments (Peoria, AZ)

Third Project: Avondale Commons Apartments (Avondale, AZ)

Fourth Project: The Falls at Crismon Commons (Mesa, AZ)

Offering Size: $1,000,000

Length: 10 years

Target IRR: 21%

$1,500,000

Saltese Creek Mixed-Use Co-GP

- Mixed-use development with 195 apartments, up to 80 finished SFR lots in Phase 1

- 128 Apartments to be added in Phase 2

- Backed by Hawkins Company

- Preferred Equity up to 75% LTC

Offering Size: $1,500,000

Length: 48 Months

Target IRR: 23%

$3,600,000

Helix 144 Apartments

- 5.25 Acres Free and Clear

- Development of 144 Apartments

- Located in the Innovation submarket of Richland, WA

- Permits Approved

- Amenities include a clubhouse, fitness center, and pool

Offering Size: $3,600,000

Length: 36 Months

Target IRR: 21.3%

$5,000,000

Flats 16

- 94 Lots, 59 Detached SFR, 35 Townhomes

- The location fronts the River Birch Golf Course on two sides

- Numerous amenities, including a dog park, pickleball court, and walking paths

- Attainable home prices with an Eagle, Idaho address

Offering Size: $5,000,000

Length: 48 Months

Target IRR: 24.1%

Recently Funded Projects

$798,000

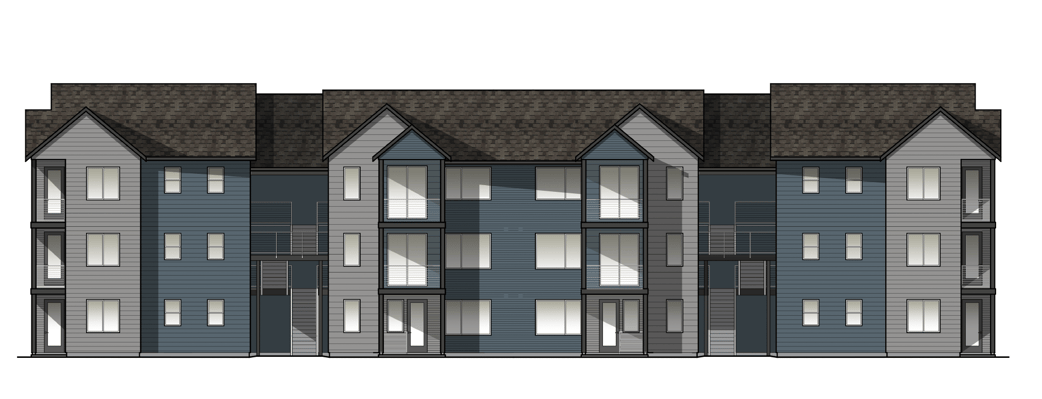

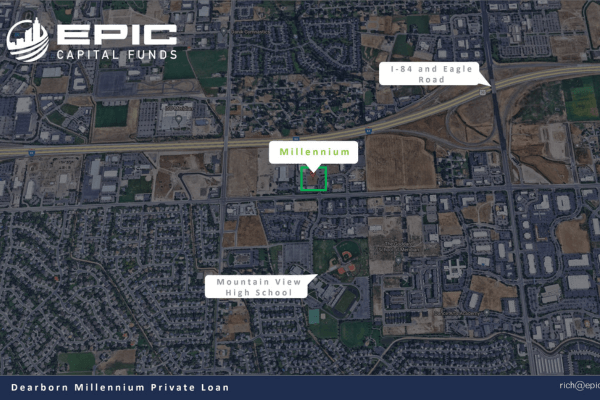

Dearborn Millennium Private Loan

- Secured by First Deed of Trust

- Excellent locations within city limits

- Zoned and approved commercial

- Strong borrower history

- Dearborn is permit ready

Offering Size: $798,000

Length: 36 Months

Target IRR:

$2,561,600

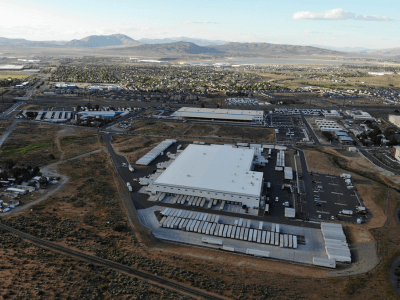

Virginia Industrial Development

We are pleased to announce the successful acquisition of Reno Industrial and the completion of the first phase of our joint venture project with Mohr Capital. Mohr submitted a PSA to purchase the land from us in October for a net gain of $450,000, which will be shared 50/50 with investors.

Offering Size: $2,561,600

Length: 4 Months

Target IRR: 31%

$2,750,000

27th Street Crossing Private Loan

- Mixed-use development with 65 multifamily units and 6,400 SF of Commercial Space on Ground Floor

- Significant demand with a current waitlist of tenants

- Construction completion target Q3 2023

Offering Size: $2,750,000

Length: 24 Months

First Year: 12%

Second Year: 13%

$2,860,000

Warm Springs Townhomes

- Build to sell model development

- 33 Single Family Townhomes

- Direct foothills access

- Easy access to downtown

- Across from the Boise River

- 4.5 miles to Micron

- Estimated project completion by the end of 2025

Offering Size: $2,860,000

Length: 36 Months

Target IRR: 22%

$10,800,000

Saltese Creek Mixed-Use

- Mixed-use development with 195 apartments, up to 80 finished SFR lots in Phase 1

- 128 Apartments to be added in Phase 2

- Backed by Hawkins Company

- Preferred Equity up to 75% LTC

CoGP Offering Size: $1,500,000

Length: 48 Months

Target IRR: 23%

$4,025,000

Coffey Townhomes on Chinden

- Project flexible as build-to-sell or rent, based on market demand

- 76 Two Story Townhomes

- Easy access to downtown Boise

- Near public transportation

- Less than one mile from the Boise River

- Estimated project completion by end of 2025

Offering Size: $4,025,000

Length: 36 Months

Target IRR: 24%

$5,775,000

Brundage Residential

-

50+/- Ski-in/Ski-Out Residences

-

1,350 to 2,600 SF Homes

-

9.52 Acres of Land Area

-

PUD Approved & Preliminary Plat

-

Health & Fitness Center, Pool & Spa, Restaurant/Bar, Conference Center

-

Fee Simple Ownership with Rental Income Opportunities

$3,113,482

ECW West Richland

-

80-unit townhome/duplex project, including 40 townhomes and 40 duplexes

-

Designed to be built out in phases, delivering 44 units in phase 1 and 36 units in phase 2

-

Amenities include a 1,200 SF clubhouse with a fitness center, storage room, common space, pool/pool house, and pickleball courts

Target IRR: 18.2%